IPO-Underpricing

Excess Returns of Initial Public Offerings or why so many firms "leave so much money on the table".

These are the 4-day-returns in % - the p.a. returns are 90-fold higher!

Source: Deutsche Börse AG; own calculations

Source Foto Bull & Bear: shop.degussa-goldhandel.de

IPO-Underpricing is the difference between the first price on the secondary market and the issue price of a share of initial public offerings (IPOs).

It is a worldwide phenomenon of almost each capital market that the issue price of initial public offerings is below the first trading price on the secondary market. Numerous empirical studies find evidence that the first trading price is about 20 per cent higher than the issue price of the shares on average. For some capital markets this difference comes even up to 55 p.c. and more. This might be glad for these investors who subscribed to the issue and received an allocation because they are enabled to realize considerable trading gains in a few days only. On the other hand, there is a considerably lower amount of money which flows into the enterprise (or the remaining shareholder) if the issue price is below the trading price on the secondary markets. Thus, many investments could not be realized.

Where do this price difference comes from? Is the issue price too low - or is the first trading price too high? How does this price difference aggree with the theorie of efficient capital markets? Is it possible to reduce the underpricing - or isn't it necessary or desirable? Why is the extent of underpricing different in the capital markets? For many of these and further questions the scientific literature provides an answer although this issue-puzzle is not yet solved.

Thus, many of the scientific explanation models reveal new problems and pose further questions, in particular because of the restricted comparability of numerous studies because of nonuniformed use of the vocabulary. Therefore, the following sides provides an overview over the current research. Besides basics (i.e. definitions, analytical methods and problems) there is also an overview over the explanation models and empirical studies.

A detailed overview over the scientific literature should help to find firsthand information.

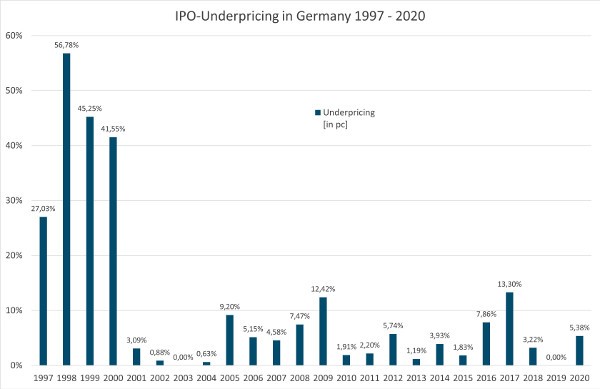

5.3 pc IPO-Underpricing from 2004-2020

Since the termination of the Neuer Markt, there has been still significant IPO underpricing in Germany averaging 5.30% (from 2004-2020). This corresponds to a capital waiver by the existing shareholders totaling EUR 7.85 billion. For a description of the monetary development of the underpricing please:

The question remains, why the existing shareholders forego this capital. Is it a conscious renunciation? What reasons could there be for this? Would underpricing be avoidable or are there (good) reasons why it should be?

The following pages therefore provide an overview of the topic: in addition to the basics and previous empirical studies and explanatory approaches, there is also an overview of the literature on the topic. However, the focus is on my own research: the market reputation thesis as a general explanation for IPO underpricing.

But the IPO-Undepricing is overvalued because of the classical calculation method. In fact, it doesn't have any meening neither for the old shareholders nor for the company itself.

A liquidity-based calculation approach shows that the real underpricing is lower than 2% only* - and that the old shareholder and the company itself will benefit from an increasing positive initial return.

Details will follow shortly in my analytical study:

Why Underpricing doesn't matter

* 1,89% - empirical analysis for German IPOs since 2005; the classical calculated Underpricing is about 5.15%..